Posts

December 9, 2022 – The newest FCC’s Workplace of Controlling Director (OMD) has announced that suggested common services fund (USF) share basis to the earliest one-fourth out of 2023 might possibly be 32.six percent.step 1 In case your FCC requires zero action to the proposed USF sum basis in this 2 weeks, it could be proclaimed recognized. Obsoleted identifies a previously authored governing that isn’t felt determinative in terms of upcoming purchases. It name are mostly found in a ruling you to definitely listing previously wrote rulings which can be obsoleted on account of changes in laws otherwise laws. An excellent ruling can be obsoleted since the substance could have been utilized in legislation next used. Pursuant so you can § 280F(c)(3), the brand new protection have to be drastically comparable to the fresh limits for the decline deductions implemented to your owners of passenger autos.

Jim Valentine: Earnest currency deposits

- It’s and mostly of the financial institutions within databases offering Cd terms of 72 and 84 months, which shell out 3.81% and you can step 3.81%, correspondingly.

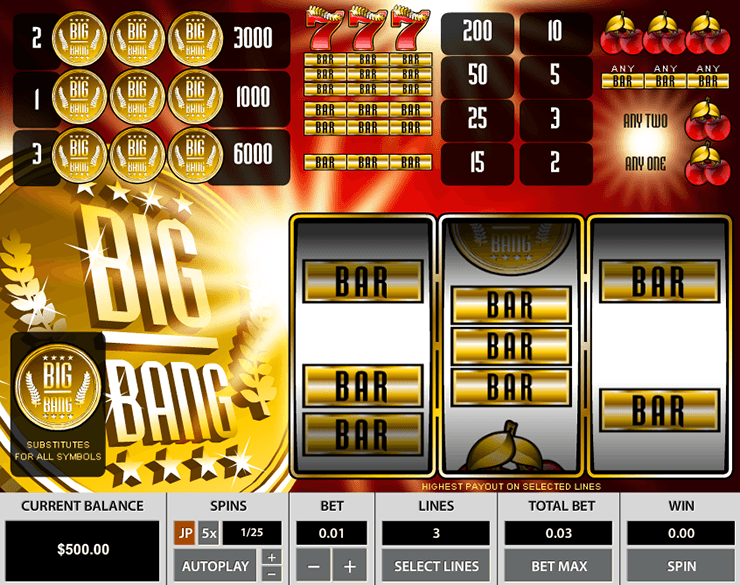

- These online flash games allow you to twist to possess only $0.01 per bullet, meaning your quick deposit can also be expand on the numerous revolves.

- If you are considering a phrase put or a bank account, it is useful to contrast the two side-by-side.

- Under the proposed money process, the newest SITCA program can be acquired to help you companies in every services opportunities (leaving out gambling community employers) having one or more business area, titled an excellent “Secure Institution,” operating under the Employer Character Matter (EIN) of your company.

- More 800 of those plaintiffs has removed monetary problems out of destroyed work output.

- Sections 3101 and you can 3111 impose Government Insurance coverage Contributions Work (FICA) fees to the staff and businesses, respectively, comparable to a percentage of your own earnings acquired by just one regarding work.

Rulings and functions advertised on the Bulletin don’t have the force and you may effect of Treasury Agency Legislation, but they can be used since the precedents. Unpublished rulings are not made use of, used, otherwise cited as the precedents by the get more Services personnel in the disposition out of almost every other instances. Within the using authored rulings and functions, the effect out of next regulations, regulations, court choices, rulings, and procedures need to be thought, and you can Solution staff although some concerned are warned against reaching the exact same findings in other cases except if the facts and you can things are drastically a similar. I result in the existence out of landlords, clients and you can a home traders smoother giving her or him the data and you may resources it care really from the.

These consequences create subscribe weaker economic results, next destroy financial locations, and possess other issue side effects. On the lack of these transform, SVBFG would-have-been susceptible to increased exchangeability risk government conditions, complete standardized liquidity conditions (we.e., LCR and NSFR), enhanced financing requirements, company-focus on be concerned evaluation, supervisory be concerned research in the a young go out, and tailored quality thought standards. With regards to financing, beneath the pre-2019 program, SVBFG might have been required to admit unrealized growth and loss on the the AFS ties profile in regulating money; because of the for instance the unrealized loss for the its AFS ties collection, inside December 2022 SVBFG’s stated regulating financing would have been $1.9 billion lower. Because of the will set you back inside, the only real reason to use mutual places should be to effectively boost covered places. The brand new column named “p50” shows the newest holding out of uninsured deposits of your own median lender in the for each and every size classification.

Kansas Protection Put Focus Conditions

They offer an ensured get back versus typical discounts membership, although not, being able to access your finances might require progress see or bear an early on withdrawal percentage. The fresh Irs get deal with a SITCA Applicant to participate in the new SITCA system since the a support World Employer in case your SITCA Candidate satisfies the requirements of which revenue process, the fresh tips accompanying the net app, and you will any next appropriate information. Through to invited on the SITCA program, the newest Irs often electronically issue a notification out of invited to the SITCA Applicant.

CBA, NAB reduce identity deposit cost – is it time and energy to key?

An analysis of one’s 2023 legal actions demonstrates that plaintiff lawyers continue to pursue bread and butter too much recordkeeping payment claims, but the amount of investment underperformance legal actions will continue to go up. 5 Centered on established investigation, the new Irs quotes the latest thinking for those rates, should your SITCA system were operating presently, would be a great 16 % SITCA Minimal Fees Idea Payment, a good dos % Cash Differential, and you can an excellent 5 per cent Firm Price. The brand new Safeguarded Business have to utilize an excellent POS Program to help you number the Conversion Susceptible to Tipping inside calendar year and should accept the same types of fee to possess info as it does for Conversion process At the mercy of Tipping. The brand new POS Program will be able to influence both Resources by the Costs plus the Safeguarded Institution Conversion process Susceptible to Costs Tipping on the season.

Plaintiffs argue that 3M is only able to improve exact same disagreement in order to a lot of judges as well as the compatible road when they disagree which have Courtroom Rodgers is to attention. Various other group of over 350 3M earplug plaintiffs gets their circumstances overlooked this week unless it fill in a fantastic records by tomorrow, August 3, 2023. In order to mitigate the risk of stock dilution as the veterans’ money dumps the fresh offers, the brand new issuance away from inventory will be carried out in the tranches. An extra level of chance administration is produced from the appointing an investment movie director and you may adviser in order to manage and lower the brand new financing dangers. Many of the twenty-six,391 EIF apps will be the most effective instances regarding the litigation. More 800 of those plaintiffs provides removed economic damage of destroyed works output.

Banking institutions I Monitor

In addition to posting the brand new surety thread, the brand new property owner shall pay for the renter interest during the rates of 5 per cent annually, effortless interest. The bond might be in the full number of the security put otherwise improve book stored on behalf of clients or in the degree of $250,100, any type of are reduced. The connection might be trained through to the brand new loyal compliance of your own property owner to your terms associated with the section and will cost the fresh Governor to the advantageous asset of people occupant injured from the landlord’s citation of the area. In addition to publish a surety bond, the brand new landlord shall spend on the tenant attention to the defense put otherwise advance rent held with respect to you to definitely occupant at the the pace of 5 % a-year effortless interest. The brand new Writeup on Deposits (SOD) ‘s the annual questionnaire away from part workplace dumps as of Summer 31 for everyone FDIC-insured institutions, as well as covered You.S. twigs away from foreign financial institutions.

Although not, it will become harder whenever landlords need to pay a portion set by condition. If your property owner is the owner of multiple systems, this may get pricey and also the landlords need for money intelligently to spend you to definitely 5% and never day-of-wallet (otherwise want a significantly shorter deposit beforehand). The fresh FBI overstepped the constitutional authority whenever agencies seemed countless safe-deposit packets rather than is deserving of inside 2021, a national is attractive legal ruled.

Needless to say, 3M’s notice-serving interpretation of your DOD information is extremely defective plus the point out that 90% of one’s plaintiffs have no loss of hearing is really misleading. Just the other day the newest MDL Judge held a “study day” to review the brand new DOD scientific study. The new court’s purpose would be to secure the lawsuit moving on inside the an enthusiastic prepared and you can effective trend. We’re sharing the us government company security as this legal actions began.